Minimum Income Requirements For 2025 Taxes. Requires billionaires to pay at least 25 percent of income in taxes. $13,850 if younger than 65, $15,700 if 65 or older.

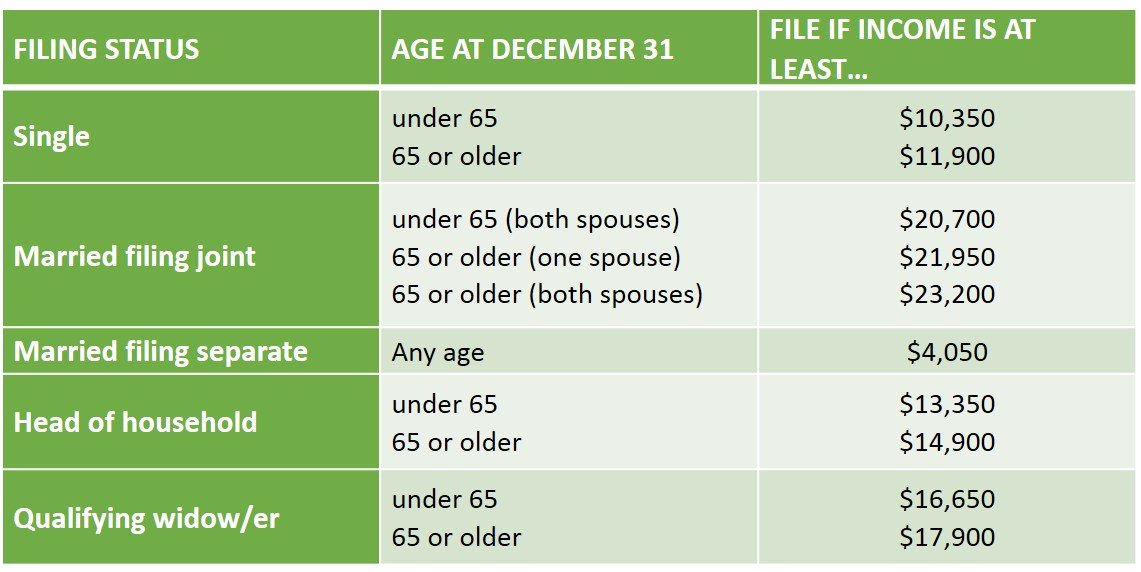

The minimum income amount depends on your filing status and age. Want to know what the minimum income is to file taxes?

When Should You File A U.S. Federal Tax Return AG Tax When, $30,700 (both spouses 65 or older) married. Only the maximum tax rate (“wealth tax rate” or “reichensteuersatz”) will continue to start at an annual income of 277,826 euros.

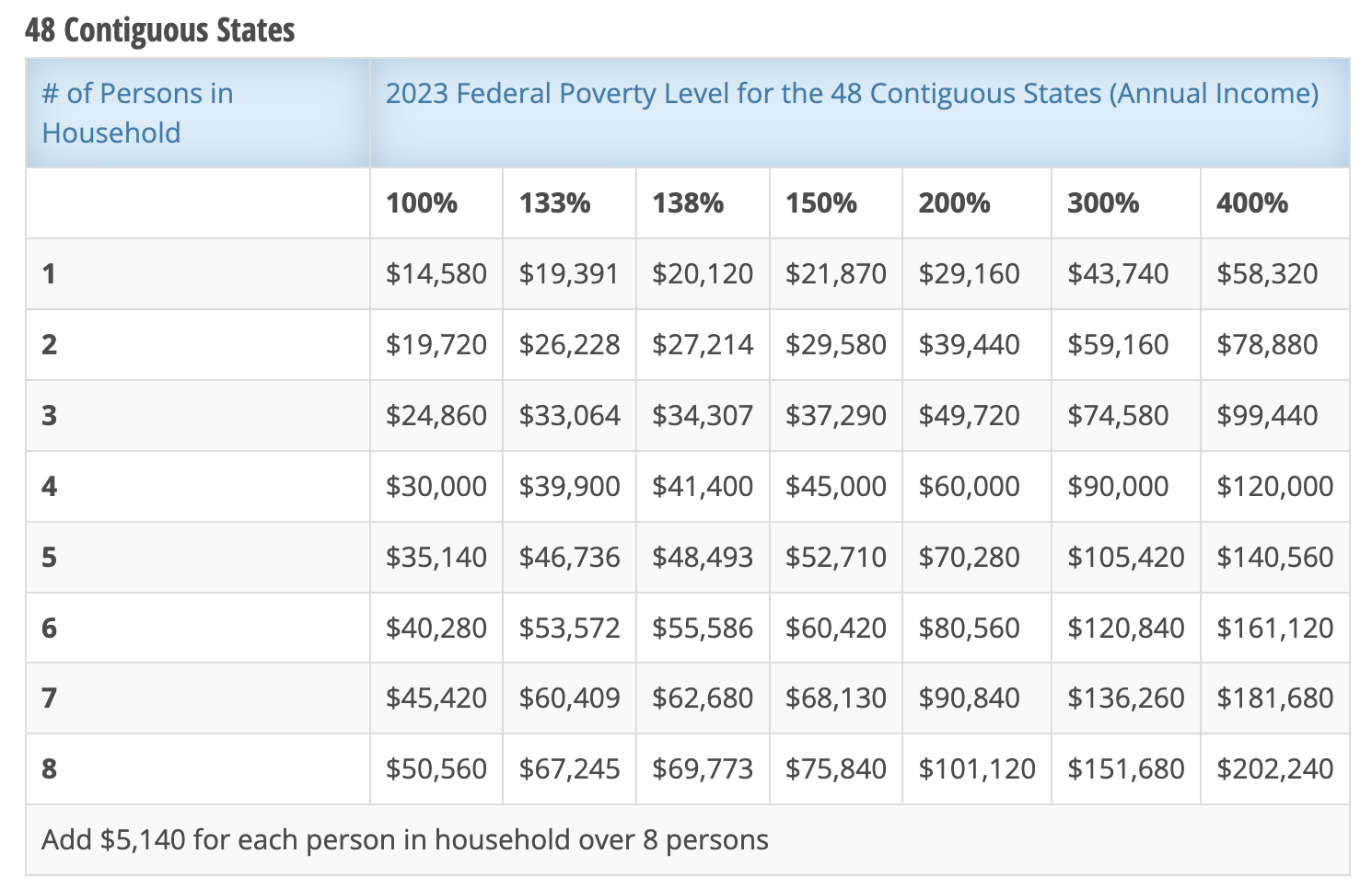

Do I Have to File Taxes?, Number of people in your household (including yourself and. In 2025, they will be raised by 6.3%.

:max_bytes(150000):strip_icc()/TaxFilingChart-b3b0026b04464a8da66bcf7c9e479b65.jpg)

The IRS announced its Roth IRA limits for 2025 Personal, For the 2025 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to the irs. In 2025, for example, the minimum for single filing status if under age 65 is $13,850.

20232024 Eligibility Guidelines CDPHE WIC, Only the maximum tax rate (“wealth tax rate” or “reichensteuersatz”) will continue to start at an annual income of 277,826 euros. Billionaires make their money in ways that are often taxed at lower rates than ordinary.

Maximize Your Paycheck Understanding FICA Tax in 2025, 2025 federal income tax brackets and rates. For the 2025 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to the irs.

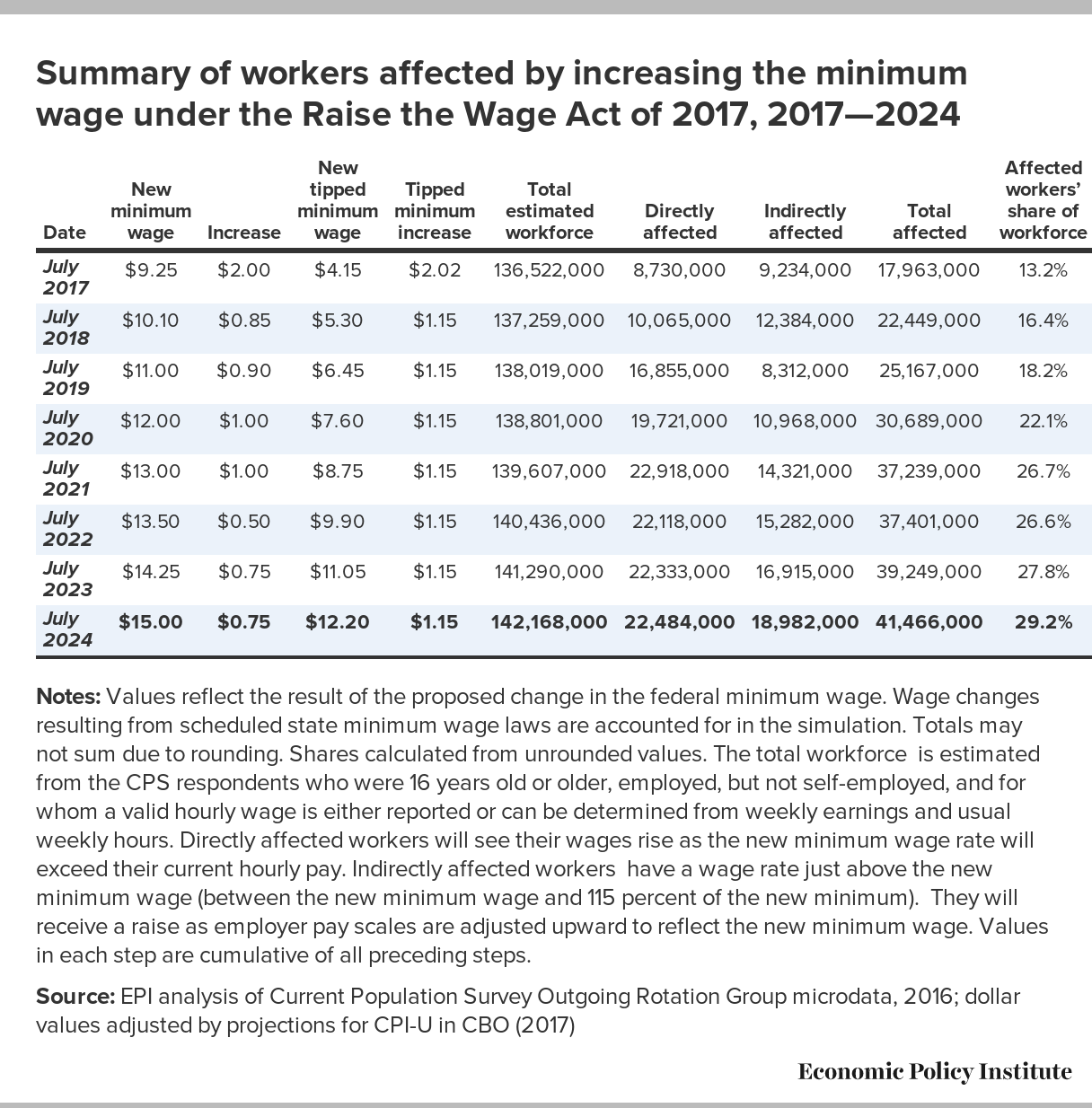

Raising the minimum wage to 15 by 2025 would lift wages for 41 million, In 2025, the top tax rate (spitzensteuersatz) will therefore apply to an annual income of 66,761 euros (2025: The irs has a variety of information available on irs.gov to help taxpayers,.

Federal Withholding Tables 2025 Federal Tax, For the 2025 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to the irs. Number of people in your household (including yourself and.

Tax rates for the 2025 year of assessment Just One Lap, In 2025, when filing as “single”, you need to file a tax return if your gross income level in 2025 was at least: In 2025, the top tax rate (spitzensteuersatz) will therefore apply to an annual income of 66,761 euros (2025:

Minimum Requirements How Much Money Do I Have to Make to File, In 2025, they will be raised by 6.3%. In 2025, when filing as “single”, you need to file a tax return if your gross income level in 2025 was at least:

USCIS Federal Poverty Guidelines for 2025 Immigration Updated, What is the minimum income to file taxes in 2025 and 2025? Billionaires make their money in ways that are often taxed at lower rates than ordinary.

In Memoriam Oscars 2025 List 2025. Da'vine joy randolph won best supporting actress for the holdovers. To see the in[...]

2025 Jeep Grand Cherokee Limited Release Date. 2025 jeep grand cherokee release date and price. Read the definitive jeep grand[...]

Cuando Es Semana Santa 2025 En Argentina. ¿cuándo cae semana santa en 2025? Calendario de feriados nacionales 2025 en argentina:[...]